Noted financial blogger Barry Ritholtz comments on macroeconomic housekeeping, the unexplored links between shrinking demand and credit-starved supply, and support for commodities and commodity-linked markets/currencies once institutional capital resumes its existential search for yield…

Noted financial blogger Barry Ritholtz comments on macroeconomic housekeeping, the unexplored links between shrinking demand and credit-starved supply, and support for commodities and commodity-linked markets/currencies once institutional capital resumes its existential search for yield…

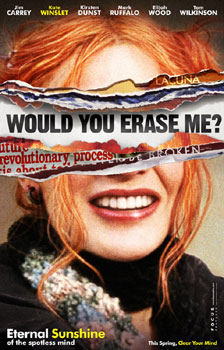

The Eternal Optimism of Opening Day

As we are one week removed from Opening Day, the eternal optimism this time of the year is always apparent. The weather gets nice and the forever belief of a fan is always ‘this is the year.’ Cub fans can relate, with no disrespect to them as I am the Cubs of my baseball fantasy rotisserie league, aka never won. There is also the hope now that 2009 will be the bear killer as we are just a few months away from matching the length of the longest post WWII recession, that of the early 1980’s. There are also fingers crossed that the extraordinary steps taken by our Fed, Treasury, Congress and President can engender a recovery.

Before I give my opinion on this, let me first give my quick background review on what brought us to today. Alan Greenspan, an Ayn Rand disciple who ironically became head of the Kingdom of Market Manipulation and industrial policy, the Federal Reserve, sowed the seeds for the credit bubble as artificially low interest rates created a mad scramble for yield that resulted in a massive misallocation of capital and huge leverage. Many go drunk at the credit party, such as consumers, bankers, other lenders and politicians, but Greenie, Mr. Bernanke and their cohorts brought the booze, the kegs, shot glasses and funnels.

The broken damn that flooded us with easy credit coincident with too much spending at all levels has brought us a total debt level to GDP of 350% and a household debt to disposable income ratio of 123%, from below 90% in 1995, both higher than in the great depression. If only the Fed let the 2000-2002 cap ex led recession run its course, I wouldn’t be here talking about monetary policy and political science. I’d be talking about P/E ratio’s, returns on equity and earnings growth instead. But, we’re here and our future right now is beholden to those who live and work in our nations capital instead of to the industriousness of our private sector.

We have B52 Ben (I upgraded him from helicopter pilot) carpetbombing us with money and he won’t stop until we have completely inflated our way out of our massive debt that ironically, as I previously mentioned, is a hangover from the last period of easy money. So Ben wants us to drink more and more to somehow cure our hangover. He and Tim Geithner are trying to put Humpty Dumpty back together again. Humpty Dumpty was a consumer that borrowed too much, spent too much and saved too little. Their new creation, the TALF, is trying to jump start the securitization market so consumers can get access to easy credit again. Huh? What’s so bad about a recession if not allowing one to happen, gets us into this mess? Why can’t we just allow Mother Nature to run its course? Also, this whole talk about once the banking system gets fixed, everything will be fine, is a fallacy. Problems in the banking system are just the symptoms. The disease is the overleveraged consumer and implosion in the housing sector. When house prices stop going down, Voila! The banking system is fixed.

In light of the policy steps of our government officials, one has to compare it to the last attempt at cleaning up the aftermath of a debt bubble, that of the Japanese. They responded with stimulus plan after stimulus plan, new bridge and road after new bridge and road, and lower and lower interest rates capped off by quantitative easing. Look where that got them. Last week’s announcement of another Japanese stimulus plan reminded me of the show on VH1, ‘I love the ‘90s’ and also the movie ‘Groundhog Day.’ My point in this is twofold. #1, in a period of huge deleveraging, the cost of money doesn’t matter if people don’t want to borrow. The Fed can bully mortgage rates down to 3% but if the home ownership rate is going back to its longer term trend of about 64% from its high of 68%, it won’t matter. Refi’s are great but the Fed is not spending $1 trillion to buy MBS to help refi’s. If this country’s savings rate is heading back to the 7-10% range, who cares where borrowing rates are. All we are doing is delaying the inevitable, however painful, consumer debt paydown. #2, I’ve never seen a period of history where one can print, borrow and spend their way to prosperity and without nasty unintended consequences as a result.

With all this uplifting talk I know, I will shift to the markets and discuss some secular themes that even bureaucrats and economists can’t screw up. That is globalization, notwithstanding the recent disgust with crony capitalism, the fall of the Berlin Wall, fall of Communism in Russia, the dramatic free market shifts in China and India, the resurgence in the rest of Asia after their crisis in 1997 and the stability in many natural resource producing Latin American countries. I’m not talking about Venezuela of course. These are long lasting trends where the taste of freedom and economic prosperity won’t go away even with the current cyclical hiccup. Yes they benefited from the US consumer growing to almost 20% of global GDP and everyone wanted to feed the beast but it was more than that. The growing middle class in many parts of the world and the need for infrastructure to complement that helped to fuel a rise in commodities which followed 20 years of underinvestment.

Commodity prices remain a key variable in determining where global markets go from here as the stability in many emerging markets are dependent on it and that is also where most of global GDP growth is. The other key variable will be the ability of Asia and other parts of the world in developing domestic led growth instead of relying mostly on US consumer buying, who has seen its best days as a % of US GDP. Outside of the US and other developed nations, debt levels are much more manageable in the developing world, particularly in Asia where savings rates are also dramatically higher.

Sorry, but enough of the happy talk as I need to shift back to the flip side of this coin. Let’s combine what I believe to be a secular bull market in commodities with the path that unelected and elected officials have taken in Washington, DC and we have sown the seeds for the next major up move. What the US and rest of the world will be left with before B52 Ben takes his office back in Princeton is much higher inflation, much higher interest rates and as a result will be a huge dark cloud hovering over any recovery the US can muster. What will benefit however are hard assets like gold, silver, platinum, oil, corn, soybeans, copper, nickel, etc… Yes we have seen a big destruction in global demand for commodities but producers have responded with big supply destruction as projects have gotten canceled left and right and the rig count, for example, is down by half. Welcome to the real decoupling. Not the failed thesis of decoupling in 2008 where many believed certain parts of the world would be immune to the growing mess in the US, but a decoupling where producing countries of natural resources will benefit at the expense of users of natural resources. Add to this, a resumption in growth in balance sheet healthy Asia led by domestic consumption and production and those countries who were the last ones into this mess will be the first ones out. The US on the other hand will be the last one out as we continue our desperate need to delever. The Russians will rejoice over $70 oil again but the US consumer will choke on $3 gasoline again. Stagflation here we come.

I bring this all together back to my views on the stock market. Ben and his copilots have made predicting the market very difficult since the afternoon they told the world that they were going to start buying US Treasuries with money printed out of thin air, thin air being where the Bureau of Printing and Engraving is with Ben working the assembly line. This changed the game because of the inevitable inflation that will arise from this path as inflating our way out of paying debt is the preferred path of any politician because the alternative is too politically painful. We can thus get nominal returns in stocks but I can almost guarantee, real returns will be tough to come by. In this environment, if you are exposed to commodities and commodity producers, you will do fine. If you are exposed to emerging markets that produce commodities, you will do fine. If you are exposed to those companies that have pricing power, you will do fine and if you are exposed to parts of Asia, particularly in China, that don’t need a vibrant developed world to get by, you will do fine.

I swing back to the Chicago Cubs for an analogy. If starting 3rd baseman Joe Schmo hits 20 homers at Wrigley Field because the wind always blowing out turns his pop ups into homers but he can’t hit a homer on the road, his year end stats look pretty good, 20 homers, but they weren’t real. If the DJIA goes to 10,000, great! But if gold goes to $2000 at the same time, maybe not so great. If the stock market was left to its own devices, than I would say 400-500 in the S&P would be its inevitable destination as 10x ’09 earnings of about $40-50 would be a fair multiple based on previous bear market bottoms. Unfortunately, our officials won’t let it happen as any recovery that may soon ensue will be darkened by the insidious hidden tax of inflation, debasement of our currency and excessive sovereign debt that will take more and more tax dollars (aka, money sucked out of the private sector and shifted to government) to finance.

We all have to understand that the Fed and Treasury have embarked on a grand experiment. We now have a marketplace where fundamental analysis is being trumped by huge event risk of a different kind, Washington, DC kind, where some new acronym program, some reckless comment from a Congressman or some new asset class Bernanke Capital Management deems attractive to him, is driving markets.

In 2006 and half of ’07 when I was bearish and the market kept soaring, I found myself saying that optimism is not a strategy, realism is. I want to say now that pessimism is not a strategy either. The cards have been dealt to us, let’s make the best of them.