While the world comes to terms with yesterday’s historic call for change, Nouriel Roubini and his team have pulled together a laundry list of the many great challenges that lie ahead…

While the world comes to terms with yesterday’s historic call for change, Nouriel Roubini and his team have pulled together a laundry list of the many great challenges that lie ahead…

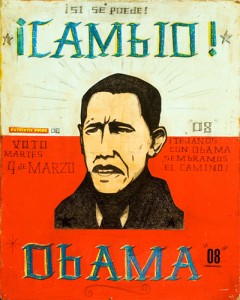

Barack Obama, the 44th President of the United States

RGE Monitor

The 2008 U.S. Presidential election was historic itself owing to the candidates’ profile. But the timing of the elections as the U.S. and global economy are in the midst of the worst financial crisis and recession in decades reminds us of the Great Depression era and the 1980s recession when incoming Presidents Roosevelt and Reagan faced immense challenges to cure the economy’s woes.

By the time Obama takes his oath in January 2009, he will face an economy which is still in a middle of a severe and prolonged recession where households will continue to face unaffordable mortgage and other debt, declining value of homes (that financed their consumption all these years), risk of debt default or foreclosure, tight access to credit with stringent borrowing conditions, erosion of their retirement savings amid the bearish stock market, over a million lay-offs taking the unemployment rate to 7-8% and critical foreign policy challenges.

Therefore, immediate challenges for Obama will include cushioning the consumers (who account for over two thirds of GDP) from the economic slowdown by means of a large fiscal stimulus package and acting on a government guaranteed mortgage modificationprogram. In fact, he has already called for fiscal stimulus in the form of grants for state and local governments, infrastructure spending to create jobs, scrap tax on unemployment insurance, tax cuts for lower income-groups and small businesses, tax credits for firms that create jobs and government aid for the ailing auto industry. Some of the tax cuts would be financed by taxing the windfall profits of oil companies. Part of his program would allow households to draw up to $10,000 from retirement funds during 2008-09 without any tax penalty. Obama also called for a ninety-day moratorium on foreclosures, modification of bankruptcy laws, a $10 bn foreclosure-prevention fund and 10% mortgage tax credit for the middle-class. But more importantly he has emphasized preventing taxpayer funded bailout of banks and giving golden parachutes to CEOs of failing institutions. He has also strongly endorsed greater financial sector oversight, control and reporting with the creation of a financial market oversight commission to oversee liquidity, capital and disclosure requirements and plans to streamlining regulatory agencies to prevent overlap and assign greater role to the Securities and Exchange Commission (SEC) to prevent market manipulation and to the Federal Reserve to carry out regulation.

The Democratic Congress will also influence on asset markets, business sentiment and financial sector regulation, as well as on the country’s energy policy and oil sector, health insurance and pharma sector, tax incidence on high income-groups and corporate sector, pre-conditions under trade talks and role of labor unions.

Tax Policy and Fiscal Deficit

Obama will face a swelling fiscal deficit which might be pushed over $1trillion in the next few years. Mounting fiscal costs of the housing and financial sector bailout and fiscal stimulus measures to sustain aggregate demand will impact the budget while the downturn puts a dent in tax revenues. Ballooning Medicare and Social Security bills will only add to his challenges.

A redistribution-oriented tax policy which gives larger tax cuts to a greater number of low and middle-income groups while raising taxes on the high-income group is at the center of Obama’s proposals. When Bush’s tax cuts expire in 2011, Obama plans to raise the federal individual income tax rate from the current 33% and 35% to 36% and 39.6% for the over $200,000 and $250,000 income-groups respectively. Tax cuts would be kept at the current rate for the rest of the income groups. However, the total tax incidence might be higher when combined with the State and other taxes. The new administration also plans to remove various exemptions and deductions for the high-income groups while extending several tax breaks and credits for the low and middle-income groups, retirees, homeowners, and students.

For the corporate sector, the plan is to cut the tax rate to below 35% and act stringently to broaden the corporate tax base and reduce loopholes, crack down on international tax havens and tax distortions and have a shareholder vote on CEO pay. The plan also includes tax breaks for firms that keep headquarters in the U.S. Capital gains and dividend tax rates are expected to go up to 20% for the above $250,000 income group. Moreover, carried interest of private equity and hedge-funds will be taxed as ordinary income (at a higher rate) rather than as capital gains.

In order to finance the Social Security shortfall from the oncoming fiscal burden of baby boomers, the new president plans to raise the earnings cap on payroll taxes from the current $102,000 income cap to the over-$250,000 income-group. The Social Security plan will also include a job-portable and tax-deferred Retirement Fund.

While Obama has pledged to follow the pay-as-you-go rule to contain the fiscal deficit, his proposals to increase spending on lower and middle income groups, infrastructure, research and technology would nevertheless raise the national debt with possible impact on Treasury yields and sources of debt financing.

A Democratic Congress might strengthen the stance to raise taxes especially amid criticism that recent tax cuts dented the fiscal deficit, created investment distortions, and raised income and wealth inequality. But the economic slowdown might limit or delay the administration’s ability to raise taxes. Moreover, there have been concerns about possible impact of these policies on U.S. competitiveness and impact on investment and small businesses.

Health Care Reform

In a country with around 47 million uninsured and the middle-class battling with rising health insurance premiums and job-immobile coverage, Obama will face an immense challenge to undertake the impending health care reform and ensure quality healthcare – that presently fails to match with even other developed countries. The President has endorsed a universal health insurance coverage which will have mandates only for children. The plan includes the creation of a regulated National Health Insurance Exchange where individual insurance can be purchased. Low and middle-income households will benefit of subsidized premiums. Firms that do not offer insurance to their employees will face a tax penalty. The improvement in the insurance coverage, in the next few years, might come with a high price tag.

Trade Policy

Regarding trade, Obama has pressed on including on labor and environmental standards in trade agreements. He has also proposed to raise duties on Chinese imports to offset the undervalued Yuan and dumping of goods and also take measures against their violation of intellectual property rights. Part of the plan also includes greater scrutiny of investments by Sovereign Wealth Funds.

Even as the global recession is increasing risk of slowdown in global trade and possible rise in protectionism, this might be exacerbated by a Democratic Congress that favors conditional trade agreements. The current financial crisis and rising significance of Sovereign Wealth Funds might also increase Congress’ aversion to financial globalization and inward foreign investment. But aversion to trade might be overrated as they realize the risk of unilaterally withdrawing from global trade.

While fair trade might be the way for survival ahead, U.S. insistence on non-tariff barriers to protect some sectors and jobs from import competition might isolate it from trade deals and possible gains from multilateral trade talks.

Labor and Middle-Class

However, the most important and significant challenge that Obama will face is alleviating the American middle-class woes due to the recession but also due to the impact of globalization on workers in the recent years. While the lower and middle-income groups have benefited from trade via cheaper imports, the net benefits from globalization are still being heavily debated.. In the most recent years, real wages have remained stagnant for the middle-class in spite of rising cost of living.

In this respect, Obama has offered to raise the minimum wage adjusted for inflation and introduce laws to make organizing unions easier. He has proposed to reform the Trade Adjustment Assistance, wage insurance and worker retraining programs.

Foreign Policy

While economic policy issues make take the fore and constrain foreign policy, many global leaders will be watching the new foreign policy team for clues of the new administration’s priorities. No shortage of challenges await – a resurgent Russia resenting NATO’s involvement in its near abroad, an Iran that remains dedicated to nuclear proliferation despite sanctions etc. Obama’s foreign policy vision has centered around multilateralism and revived diplomacy – something for which European allies have been longing – to further US interests at a time when the U.S. military is engaged in two wars. Iraq and Afghanistan will likely consume much of the administration’s focus – Obama has pledged to withdraw troops from Iraq within 16 months of taking office and counter resurgent Qaeda and Taliban forces in Afghanistan. Meanwhile, economic and not political ties may continue to define the U.S. relationship with key Asian economies, including China, its largest creditor.

But finding common ground with China, the second largest consumer and importer of oil, may be required to meet energy policy and anti-climate change goals. Obama has stressed conservation and use of alternative fuels to meet America’s energy needs in order to reduce US oil imports and its trade deficit. However, the lower price of oil and worsening economic outlook expenditures may reduce some of the political will around cap and trade policies as well as reducing pressure to begin offshore drilling.