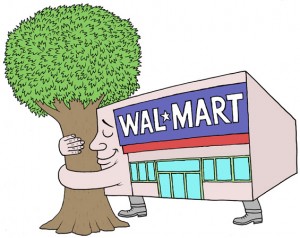

It isn’t everyday that mega-corporations act outside of their own financial interest. It simply isn’t in their design. But suppose that it was possible to expand profitability by reducing environmental impact, sourcing sustainable products, and pushing “green” across an entire supply chain. Such is the latest logic out of Bentonville, Arkansas, where the world’s largest retailer and private sector employer is taking a decidedly new approach to the age-old challenge of perpetual corporate growth, and blazing a profit- and eco-friendly trail for other industrial titans to follow…

The Greening of Wal-Mart

By Erica L. Plambeck and Lyn Denend

Stanford Social Innovation Review, Spring 2008

In 1989, Wal-Mart Stores Inc. launched one of the first major retail campaigns to sell environmentally safe products in recyclable or biodegradable packaging. The corporation promoted these eco-friendly products by labeling them with green-colored shelf tags. Although the company boasted more than 300 green products at its peak, it did not directly set or monitor the environmental standards of its suppliers. This resulted in negative publicity for Wal-Mart when the public learned that a green-labeled brand of paper towels had only a recycled tube – the towels themselves were unrecycled paper treated with chlorine bleach. The green tag program began to wane, and by the mid-1990s environmental issues seemed to have slipped off the company’s list of priorities.

In 1989, Wal-Mart Stores Inc. launched one of the first major retail campaigns to sell environmentally safe products in recyclable or biodegradable packaging. The corporation promoted these eco-friendly products by labeling them with green-colored shelf tags. Although the company boasted more than 300 green products at its peak, it did not directly set or monitor the environmental standards of its suppliers. This resulted in negative publicity for Wal-Mart when the public learned that a green-labeled brand of paper towels had only a recycled tube – the towels themselves were unrecycled paper treated with chlorine bleach. The green tag program began to wane, and by the mid-1990s environmental issues seemed to have slipped off the company’s list of priorities.

Meanwhile, Wal-Mart’s reputation among consumers was also slipping. Issues surrounding its competitive practices and labor policies loomed large in the public eye. “The company’s environmental record was nothing to boast about, either,†according to one Fortune article.1 Indeed, a 2005 McKinsey & Company study found that between 2 percent and 8 percent of consumers had stopped shopping at Wal-Mart because of the company’s practices.2

Against this backdrop, Wal-Mart CEO H. Lee Scott Jr. unveiled a new plan to reduce the company’s environmental footprint. In an October 2005 speech broadcast to all 1.6 million employees in all 6,000-plus stores and shared with some 60,000 suppliers worldwide, he announced that Wal-Mart was initiating a sweeping “business sustainability strategy.†The idea was to reduce the company’s impact on the environment through a commitment to three ambitious goals: “To be supplied 100 percent by renewable energy; to create zero waste; and to sell products that sustain our resources and the environment.†3

But these weren’t the plan’s only goals.

“Sustainability represents the biggest business opportunity of the 21st century,†says Jib Ellison, founder of Blu Skye Sustainability Consulting, which helped Wal-Mart formulate its business sustainability strategy.4 His firm pointed out that actively pursuing an environmental agenda would help Wal-Mart differentiate itself from its competition, maintain a license to grow, and make its supply chain dramatically more efficient. In other words, a good business sustainability plan would help Wal-Mart get even better at what it does best: drive down costs to generate profits.

To go green, Wal-Mart, with its headquarters in Bentonville, Ark., would have to think outside the “Bentonville Bubble.†For years, the company had operated in relative isolation from its external stakeholders, including nonprofits, government agencies, consultancies, and academic institutions. Without much in-house expertise on sustainability and environmental performance, it would need to involve these stakeholders in its new plan.

Moreover, as the paper towel incident illustrated, most opportunities for environmental improvements resided with suppliers. “If we had focused on just our own operations, we would have limited ourselves to 10 percent of our effect on the environment and eliminated 90 percent of the opportunity that’s out there,†says Tyler Elm, who was Wal-Mart’s senior director of corporate strategy and business sustainability at the time the initiative was launched.

And so Wal-Mart began to reach out to its external stakeholders. The corporation first identified areas of maximum environmental impact and then invited stakeholders to join 14 “sustainable value networks†– such as the seafood network and the packaging network – to work toward business and environmental sustainability in each area. (See “Wal-Mart’s Sustainable Value Networks,†above.) In return, network participants would gain information about and say in Wal-Mart’s operations.

Elm and Andrew Ruben, Wal-Mart’s vice president of corporate strategy and business sustainability, directed Wal- Mart’s network leaders to “derive economic benefits from improved environmental and social outcomes,†says Elm. “It’s not philanthropy,†he adds. By the end of the sustainability strategy’s first year, the network teams had generated savings that were roughly equal to the profits generated by several Wal-Mart Supercenters, Ruben and Elm report.

After interviewing more than 40 representatives from Wal-Mart and its network partners, we have uncovered seven practices that help the networks work for the environment, for stakeholders, and for the company’s bottom line. (See “Networking the Wal-Mart Way†on p. 58 for a summary of these practices.) Four of these practices extend Wal- Mart’s own managerial capabilities through the expertise and involvement of its network partners; the other three help motivate suppliers. To illustrate these practices, we explore three different networks in depth: seafood, textiles, and electronics. These examples also highlight some possible shortcomings of Wal-Mart’s approach.5

Certified Seafood

In 2006, Science published a study predicting that all species of wild seafood would collapse within 50 years.6 That same year, Wal-Mart’s seafood business grew roughly 25 percent, to approximately $750 million. “I am already having a hard time getting supply,†says Peter Redmond, vice president for seafood and deli and captain of the Wal-Mart seafood network. “If we add 250 stores a year, imagine how hard it will be in five years!â€

Continuity of supply is the greatest challenge for Wal-Mart’s seafood network, explains Redmond. One way Wal- Mart could prevent further depletion of fish stocks while ensuring its continuity of supply is to buy fish that has been caught and processed using sustainable fishing practices. Rather than defining new standards for certifying sustainable practices, Redmond understood the advantages of tapping into a well-defined third-party certification program.

By partnering with the Marine Stewardship Council (MSC), which managed the leading program in the field, Wal- Mart would avoid criticism that its standards were not stringent enough while leveraging the established expertise of the MSC and its partners. Tapping into a successful program would also help the company achieve results faster than working alone.

Through this partnership, the MSC, which Unilever and the World Wildlife Fund (WWF) launched in 1997, maintains the standards for sustainable fisheries and certifies independent third parties to audit and accredit fisheries and processors throughout the supply chain. An MSC eco-label signals to shoppers that the fish has been harvested and processed in a sustainable manner from “boat to plate.â€7 By raising consumer awareness, MSC hopes to stimulate demand and thus motivate the industry to shift to more sustainable fishing practices.8

Wal-Mart, in turn, commits to working with MSC-certified suppliers, giving suppliers an incentive to seek certification – a time-consuming and expensive process. In 2006, Wal-Mart announced a highly ambitious goal to carry 100 percent MSC-certified wild-caught fish in its stores within three to five years. As the supply of MSC-certified fish is currently far from adequate to meet Wal-Mart’s demand, this public announcement was effectively a commitment to buy from all fisheries that become MSC-certified.

The WWF plays another integral role in the partnership by helping boat operators and processors prepare for certification by identifying problems that need to be fixed (e.g., strengthening management practices, rebuilding stocks, and reducing environmental impacts) before they can be certified. This activity helps fisheries become certified more quickly to keep pace with the sharp increase in demand for certified seafood.

Another benefit of certification is that it establishes a clear view of each fish’s chain of custody. “One of the problems we had was how much of our fish was coming to us third-, fourth-, or even fifth-hand,†says Redmond. “Sometimes our supplier turned out to be nothing more than a packer who was going out to a market saying, ‘I need 50,000 lbs. of salmon no matter where it comes from.’â€

Greater transparency in the seafood supply chain allows Wal-Mart to select better suppliers, simplify the chain of custody, minimize paperwork, reduce transaction and transportation costs, and improve the quality of the fish it receives – all while improving environmental outcomes.

The nonprofits in Wal-Mart’s seafood network win, too: Both the MSC and WWF are attracting suppliers who might otherwise have eschewed certification to capture or keep Wal-Mart’s business. And their programs have gained unprecedented levels of visibility through Wal-Mart’s involvement. This visibility helps them build clout with consumers and get other retailers interested in carrying more sustainable seafood.

Trustworthy Textiles

Unlike seafood, cotton is not in short supply. Yet farming conventional cotton creates millions of tons of pollution every year. In contrast, organic cotton farming is gentler on the environment and on farmworkers’ health.

With labels that appeal to parents by emphasizing the softness and chemical- free nature of organic cotton, Wal- Mart has generated strong sales of organic cotton baby clothes – among other products. Wal-Mart customers are typically unwilling to pay extra simply because a product is better for the environment. When customers think that a product is better for their own or their family’s health, however, they’re more likely to dig deeper in their pockets to pay for it.

Both Wal-Mart and its customers initially had to pay more for organic cotton. Beth Schommer, a former Wal- Mart divisional merchandise manager for infants and toddlers, describes the pricing strategy when the program first started: “A little organic shorts set was maybe $10.94, whereas a similar non-organic outfit would have been priced at $6.94. So, yes, there was a price premium compared to other Wal-Mart products. But when you consider a $10.94 organic shorts set out there in the marketplace, that’s not expensive.â€

Nevertheless, to bring prices closer to those of conventional cotton, Wal- Mart is attempting to expand its organic cotton business. Nonprofits and government agencies are playing a significant role in this effort. To select and uphold certification standards for organic cotton farming and manufacturing, Wal- Mart’s textile network partnered with the Organic Trade Association and Organic Exchange. These groups helped convince the company to adopt the U.S. Department of Agriculture’s standards for the growth of organic cotton – regardless of where the cotton is grown. They also advocated use of the Global Organic Textiles Standard for processing. “This is probably the toughest standard out there in the industry for organic processing and handling, and [now] it’s the only certification process that can be followed for organic products coming to Wal-Mart,†says Kim Brandner, senior brand manager of sustainable textiles for Wal-Mart.

By using external standards and accredited third-party organizations to certify practices at each link in the supply chain, Wal-Mart can guarantee that its products are, indeed, organic. The company can also minimize criticism that its involvement will dilute the stringent measures that organic products must meet (a concern raised by organic farmers, retailers, and NGOs alike). In addition, relying on network partners allows the company to accomplish its objectives without major investment because suppliers absorb most of the costs of certification.

Like the seafood supply chain, the textile network has become more efficient with the advent of certification. “It used to be that if Wal-Mart was buying Champion T-shirts, [it] wouldn’t look past Sara Lee [which held the license for Champion products]. [It] didn’t think about the spinner, or the dyer, the ginner, or the farmer,†says Diana Rothschild, a former Wal-Mart employee and Blu Skye consultant to the textiles network.

But now Wal-Mart is forging ties much further up the stream of its supply chain to become more efficient and to reduce costs. “We used to buy cotton from Turkey, ship it to China for spinning and knitting, and then ship it again to Guatemala to be cut and sewn,†explains Brandner. “Now … we’re finding opportunities to do things like eliminate the shipment to China and have all processing done in Guatemala.†Going directly to Guatemala not only saves time and money for Wal-Mart, but also further reduces the company’s impact on the environment by lessening the amount of fuel and other resources used in shipping.

Wal-Mart is also cultivating closer relationships with its suppliers. Previously, textile buyers selected manufacturers on the basis of the cost and quality of their products. As a result, relationships with suppliers tended to be transactional and short-lived. Now Wal- Mart employees interact with more suppliers, more often, more directly, and for a greater duration than ever before. These closer relationships are necessary to sustain initiatives like the organic cotton project.

A major transformation within Wal- Mart has made it easier to have closer relationships with suppliers. In the past, textile buyers had been generalists, handling a variety of responsibilities. Now the textiles network divides the buyer role into four different job categories so that some buyers are dedicated to maintaining long-term relationships with suppliers. These employees are encouraged to hold their positions for many years, as opposed to the 12- to 18-month rotations that Wal-Mart buyers typically complete. According to Brandner, these organizational changes, backed by the company’s focus on sustainability, have not only supported the objectives of the textile network, but also led the team to ask better questions. “It’s helping us become smarter merchants,†he says.

Another way that Wal-Mart is using its network is to build bridges between suppliers and environmental nonprofit organizations. For instance, when the Chinese government threatened to shut down a number of textile dye houses in Beijing, including one of Wal-Mart’s suppliers, to reduce pollution in time for the 2008 Olympics, Wal-Mart immediately took action. “We put the dye house in touch with one of the NGOs in our network, which helped it formulate a more environmentally friendly process that reduced its toxic output very quickly,†says Brandner. “Although other retailers were negatively affected by the shutdown of their Chinese dye suppliers, we did not have any of our production capacity cut with this vendor.â€

To boost supplies of organic cotton and help more farmers make the transition from conventional to organic farming, Wal-Mart has begun making longer-term commitments. For example, rather than working season to season, as the company has done in the past, it made a five-year commitment to buy organic cotton from a group of farmers. “It gives them confidence and stability,†says Lucy Cindric, senior vice president and general merchandise manager of Wal-Mart’s ladies wear division and captain of the textiles network.

The company is also helping farmers manage some of organic farming’s challenges. “Organic farmers can’t grow cotton in the same field for an extended time because it depletes the soil of nutrients,†explains Rothschild. This forces farmers to alternate cotton with legumes, vegetables, and other crops to rejuvenate the soil. To meet organic standards, however, farmers must grow their alternate crops organically. Because alternate crops are not as lucrative as organic cotton, “this creates the temptation for farmers to turn to nonorganic farming,†she says. To help solve this problem, Wal-Mart agreed to purchase some of the organic cotton farmers’ alternate crops – an initiative that was synergistic with the efforts of the company’s sustainable value network focused on food and agriculture.

Eco-Friendly Electronics

In 2004, the United States exported 80 percent of its electronic waste to developing countries, where the waste led to pollution levels hundreds of thousands of times higher than those allowed in developed countries.9 Despite this off-shoring of pollution, computers and other electronics still account for some 40 percent of the lead in U.S. landfills.10

One of the objectives of Wal-Mart’s electronics network is to reduce these environmental impacts by recycling or disposing of e-waste more safely, as well as by designing electronics that don’t contain hazardous materials in the first place. Another objective is to increase the energy efficiency of its electronics. The network has encountered more challenges in managing e-waste because of the complexity of electronics design and sourcing, the difficulty of measuring the hazardous content of electronics, and the necessity of consumer behavior change to accomplish recycling and safe disposal of used electronics. In contrast, the network has more readily increased energy efficiency because this outcome is easier to measure and to market to consumers.

The sheer complexity of electronic products and the electronics supply chain makes certifying that they are free of hazardous materials costly and difficult. Most electronic products are made up of sophisticated components that are sourced through complicated, multilevel supply chains. In these supply chains, one set of suppliers sources raw materials, another set assembles those materials into components, yet another set aggregates these components into more complex parts, and so on. At each link in the supply chain, suppliers have technical expertise and proprietary information that Wal-Mart cannot access. When Wal-Mart cannot ensure that all components in a product are free of hazardous materials, the company cannot promote the product as eco-friendly to consumers.

For example, Wal-Mart wanted to be the first retailer in the United States to sell personal computers that complied with the European Union’s Restriction on Hazardous Substances (RoHS). And so the retailer negotiated a deal with Toshiba to supply RoHS-compliant com- puters to Wal-Mart stores. In exchange for buying 12 weeks’ worth of these computers (as opposed to making a typical four-week commitment), Wal-Mart procured the environmentally preferable PCs at no additional cost. Nevertheless, because the company had no way of guaranteeing that the computers did, in fact, meet RoHS standards, Wal-Mart decided to play it safe and not promote the computers’ environmental benefits.

Another way to reduce e-waste is to encourage consumers to recycle their electronics. Yet recycling offers no immediate personal benefit to consumers, and instead requires additional cost and effort. Because changing consumer behavior without palpable benefits is extremely difficult, the electronics team has not gained much ground on the recycling front.

In the area of increasing energy efficiency, the electronics network has had more success – largely because Wal- Mart can easily test product performance. One organization that helped the retailer in this endeavor is the Green Electronics Council (GEC), a nonprofit that works with electronics manufacturers and other stakeholders to improve the environmental and social performance of electronic products.

With the GEC, Wal-Mart designed an Internet-based scorecard on which suppliers indicate how environmentally sustainable their products are. This scorecard includes measures of energy efficiency, durability, and end-of-life solutions. The GEC and Wal-Mart are also co-sponsoring a contest to design consumer electronics that excel on all of the scorecard’s metrics. Wal-Mart will carry the winner’s product in its U.S. stores.

The electronics network has learned that improving environmental performance depends not only on its network partners, but also on consumers. “What’s always been difficult is to figure out the things that you can start with that are relevant to … the business or ultimately the consumer,†explains Ruben. For example, consumers care about phantom load [the amount of energy a product consumes when it is on but not in use] because reducing phantom load results in electricity cost savings. Conversely, although recycling may be the right thing to do, it does not directly benefit consumers.

As a result, Wal-Mart has partnered with the GEC and other members of its electronics network to focus on a relatively small, manageable set of metrics with important benefits for both consumers and the company. Of particular interest are measures that could help reduce costs or create new revenue streams for the company. For instance, if the metrics on the company’s electronics scorecard encouraged suppliers to develop upgradable products, Wal-Mart could sell the upgrades while delaying the disposal of the more durable goods. Implementing these changes, however, would take some time to accomplish.

A New Kind of Networking

At the heart of Wal-Mart’s business sustainability strategy is a shift from generating value through price-based, transactional interactions toward generating value from longer-term, collaborative relationships with nonprofits, suppliers, and other external stakeholders. Through its sustainable value networks, Wal-Mart gains a whole-system perspective that helps the retailer find profitable ways to address environmental issues such as fishery depletion, climate change, and pollution. In exchange, nonprofit network members stand to make giant leaps toward their missions because of the scale of Wal-Mart’s operations. And suppliers enjoy not only the stability that closer relationships with the retail giant brings, but also the assistance and guidance of Wal-Mart’s nonprofit partners.

Although Wal-Mart’s sustainability strategy appears to be off to a promising start, the company must proceed carefully as it seeks to sustain and expand its network approach. First, Wal-Mart must carefully manage its partnerships to avoid increasing its costs. The company’s reputation is on the line as it makes ambitious promises – for example, to sell only MSC-certified wild-caught fish. Because Wal-Mart is dependent on suppliers in its networks to fulfill those promises, suppliers may try to leverage their improved position of power to negotiate higher prices, particularly in times of scarcity. More dependent on longer-term relationships with fewer suppliers, Wal-Mart might also lose its ability to buy products from lower-cost sources. In addition, as its ties with nonprofit organizations deepen, Wal-Mart may face pressure to reduce its environmental impacts in ways that increase production costs.

To resist upward pressure on costs, Wal-Mart can become still more efficient. It can also continue to partner with nonprofits to develop and implement innovations. And in its relations with suppliers, it can keep prices for green products low by committing to purchase greater quantities on the front end, rather than paying price premiums on the open market.

Wal-Mart must also pay careful attention to the balance of green and conventional products in its stores. In the past, Wal-Mart narrowly focused on its customers’ immediate desires when planning product assortments. Now the company is taking on the additional responsibility of offering eco-friendly products, as well as of educating customers about these green alternatives. At the same time that green products help attract new customers, they also cannibalize sales of conventional products.

Moreover, with fewer suppliers from which to choose and more nonprofits offering their input, Wal-Mart might overlook opportunities to stock innovative or desirable products that are not necessarily green. For example, many nonprofit partners advocate against the use of polyvinyl chloride (PVC) plastics, which may have negative effects on human health. Yet some suppliers argue that the negative effects of PVC are unproven. They also say that customers demand the strength and flexibility that only PVC can provide.

Wal-Mart’s job is to manage these tensions, weighing the demands of customers against the concerns of network partners. To offer a profitable mix that includes more green products, Wal- Mart can retire conventional products in favor of green alternatives, work with governments to test materials and provide toxicity data to consumers, and seek government incentives for green products.

A final risk that Wal-Mart’s sustainable value networks must proactively manage is losing its nonprofit partners. Because of the high numbers of nonprofits participating in the networks, individual groups may be unable to claim credit for a specific, measurable reduction in environmental impact.

Over time, groups’ inability to prove their impact may cause problems with fundraising, as donors increasingly demand performance data.11 And despite the current optimism about Wal-Mart’s efforts, donors might gradually balk at paying for environmental programs that are profitable for Wal-Mart – especially because Wal-Mart pays some of its sustainability consultants but others work for nothing. And although unpaid nonprofit partners presumably retain more leverage to criticize and influence Wal-Mart, their donors may worry that this leverage will erode as the nonprofits’ relationships with Wal-Mart deepen.

Eventually, problems with fundraising could cause environmental nonprofit organizations to withdraw from the networks. Wal-Mart might avoid this issue by relying less on paid environmental consultants and ensuring that each nonprofit partner can point to its own measurable contributions to sustainability. More than anything else, Wal-Mart’s network approach must remain profitable if it is to be sustainable in the long run and achieve Scott’s environmental goals.

1 Marc Gunther, “The Green Machine,†Fortune, July 31, 2006.

2 Pallavi Gogoi, “What’s With Wal-Mart’s Sales Woes?†BusinessWeek, Nov. 29, 2006.

3 Lee Scott, “Twentieth Century Leadership,†Wal- Mart, Oct. 24, 2005. http://www.walmartstores.com/Files/21st%20Century%20Leadership.pdf

4 Much of the material for this article, as well as all quotations unless otherwise cited, is drawn from the Stanford University Graduate School of Business case study titled “Wal-Mart’s Sustainability Strategy†(GSB No. OIT-71) and associated teaching notes by Erica L. Plambeck and Lyn Denend.

5 For more information on supply chain management practices, see Erica L. Plambeck, “The Greening of Wal-Mart’s Supply Chain,†Supply Chain Management Review, May/June 2007.

6 “Science Study Predicts Collapse of All Seafood Fisheries by 2050,†Stanford Report, Nov. 2, 2006.

7 Erica Duecy, “Darden, Wal-Mart Ride Seafood Sustainability Wave, Buoy Advocates,†Nation’s Restaurant News, Feb. 13, 2006, p. 8.

8 Ibid.

9 Seeraj Mohamed, “Dumping Electronic Waste in Developing Countries,†The Society for Conservation and Protection of the Environment, April 24, 2002.

10 Matthew Brodsky, “The RoHS Revolution,†Laptopical.com, March 3, 2006.

11 “Conservation: Peering at the Future,†The Economist, June 19, 2004.

ERICA L. PLAMBECK is an associate professor of operations, information, and technology at the Stanford Graduate School of Business and a senior fellow at the Woods Institute for the Environment at Stanford University. She received the Presidential Early Career Award for her research on relational contracting in supply chain management.

LYN DENEND is a research associate at the Stanford Graduate School of Business, where she partners with faculty members to develop case studies in a variety of fields.